When the Capital and Securities Markets rally, as they did today, based upon news regarding a sovereign's (or several sovereigns', as in the ECB, for example) planned or approved issuance of debt to combat an economic crisis, it clearly signals that the movers and shakers of the world's economies and central banking systems have forgotten that a hyper extension of credit is precisely what pushed the entire world into a still-unresolved economic crisis.

While I am told that the public's memory is short, and that in a crisis "hope springs eternal," I think that the most important interpretation of events to be gathered from this unsupported market elation is that we, as a global society, have become addicted to debt, and to the false notion that debt (with or without underlying productivity) automatically fuels economic growth.

It does not. It never has. It never will.

The ebullience in the article extract which follows from the esteemed New York Times should frighten anyone who understands the true cost of debt in the longer term. We are putting flimsy bandages on gangrene and ignoring the root cause of the condition, leaving it untreated and to worsen. We are a world of debt addicts, mortgaging any asset, existing or as yet uncreated, in order to buy more without earning more.

It is axiomatic to any economist: Consumption cannot be sustained without production. And Employment is created by opportunities to produce - not by decorations of devalued and unsupported debt.

We are, in practical terms, paying for our current necessities with credit cards. After you've read this upbeat article, I will give you The Global Futurist Blog's assessment of a near-term and a longer-term scenario.

Yes, folks. I'm willing to offer some prospective and highly likely futurescapes. Douglas E. Castle only goes this far out on a limb when he knows that he is highly likely to be correct in his prognostication.

---------------

Breaking News Alert

The New York Times

Thursday, September 6, 2012 -- 4:17 PM EDT

-----

S.&.P. 500 Closes at Four-Year High After European Bond Plan

Decisive moves by the head of the European Central Bank sent the benchmark American stock index to a four-year high and fueled hopes that the foundation for a more lasting solution to the European debt crisis may be taking shape.

The markets have greeted several previous efforts to solve Europe’s economic woes with euphoria, only to be quickly deflated. While investors were bracing for the latest plan to run into problems, there were numerous signals that this plan may have staying power.

The Standard & Poor’s 500-stock index jumped 2 percent by the close to its highest level since January 2008. The Dow Jones industrial average added about 244 points, or 1.9 percent. And the Nasdaq composite index gained 2.2 percent for its highest close since December 2000.

Read More:

http://www.nytimes.com/2012/09/07/business/daily-stock-market-activity.html?emc=na

---------------

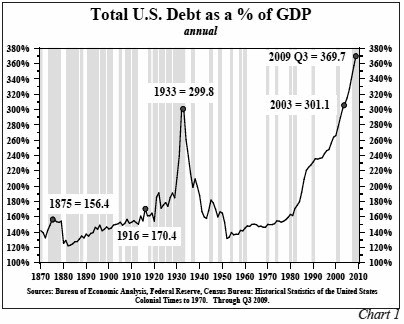

Here is what I see. The trend is frightening. In effect, we are incurring more and more debt with less and less production (income) with which to service (pay) it. Observe:

If we were to extend this chart to include 2011, 2012 and projections for 2013, you would see a further spiking in the ratio until the graph looked like it was bound heavenward. We are drowning in debt in the US, and the rest of the world is following our misguided example.

Central banks are buying back debt at inflated prices in order to prop up its paper value, and then they are issuing subsequent rounds of debt with which to pay the interest and principal on the debt that they have absorbed.

A real-world market cannot be cured by manipulation. A Ponzi Scheme of pyramiding indebtedness eventually runs out of places to go for more money... and like a chapter out of the Book Of Madoff, the issuers of the money ask to be repaid. Without increased production, employment and income, we are building a palace of paper. Someone will drop a match sooner or later.

Predictions

1) Within the next 18 to 24 months the US will experience the deepest depression it has felt since 1929;

2) Within the next 20 to 36 months, the industrialized nations of the world will follow suit;

3) During the above time frames (superimposed), the businesses of banking and investment banking will be separated in a return to the reasoning behind Glass - Steagall;

4) Non-Asian unemployment and underemployment will skyrocket;

5) The capital markets will be stalled, and the only investment opportunities will be those that offer direct participation and cashflow ["cash-on-cash returns"];

6) Violence and wars will escalate to a greater extent than ever in modern history. Militant and militia groups will be in a state of war against their own national governments. Government offices, tax bureaus, banks and other institutions which are unpopular now will become the targets of domestic terrorism.

That should hold everyone for a bit. I wish that I had better news.

Douglas E Castle for The Global Futurist Blog and The Daily Burst Of Brilliance Blog

No comments:

Post a Comment