Share this ARTICLE with your colleagues on LinkedIn .

Some Near-term Trends and Observations at 04.12.2010

Dear Readers:

Some interesting headlines and brief articles from some of the more extreme news sources (actually, in many cases these are conjecture sources) may be a source of some useful information. An eclectic sampling follows:

1. From Robert Livingston's ultra-conservative Liberty Digest :

The Art of the Lie

When my children were growing up I could usually tell when they were lying to me. A subtle fidget, a flicker of the eyes or the pitch of their voice would give them away.

That’s because they were taught from the start that lying was wrong. My wife and I drummed it into them, and they believed it. Since they knew what they were doing was wrong it was difficult for them to pull it off.

I’ve always been pretty good at spotting liars. Not as good as Dr. Cal Lightman from the

Fox show

Lie to Me; but pretty good. It was a gift that served me well as a reporter.

Of course it’s a lot easier to spot a lying politician today than it used to be. How do you know they’re lying? It’s cliché, but, it’s when their lips are moving.

Did you watch any of the President Barack Obama’s recent State of the Union address? I tried counting his lies but within about 15 minutes I ran out of fingers and toes. No matter, his life is a lie—from his sham birth certificate to his autobiography to his campaign promises to his pledges as President. But the amazing thing is that he does it so effortlessly. And he’s so good at it he’d probably get away with it if those nasty facts didn’t keep getting in the way.

He promised transparency during his campaign, but does everything behind closed doors. He promised healthcare negotiations on C-Span. But negotiations are done in secret. He promised everyone they could keep their doctor, but the public option would end that. He says if someone has another idea he’ll listen, but he shuts dissenters out of the process. He says the Supreme Court overturned 100 years of law, but Justice Samuel Alito says, “Not true.”

Obama also bashed lobbyists. That was right before he invited them to sit in on White House briefings. In his SOTU speech he said: “We face a deficit of trust—deep and corrosive doubts about how Washington works that have been growing for years. To close that credibility gap, we have to take action on both ends of Pennsylvania Avenue—to end the outsized influence of lobbyists; to do our work openly; to give our people the government they deserve.”

Hmm. I wonder why there’s a “deficit of trust.” Maybe it’s because of things like his failure to mention that more than 40 ex-lobbyists work in his administration, as the

The Washington Examiner reports.

More...

2. From The Yahoo! News Blog, a bit more "progressive" as they have been stereotyped:

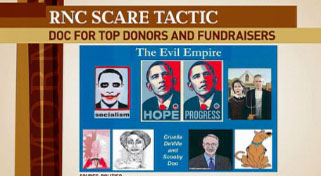

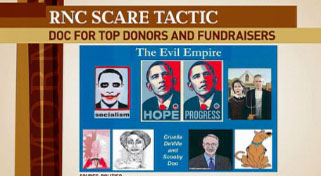

Leaked documents reveal GOP plan to use scare tactics to raise money

National GOP leaders are doing damage control today after a

Politico scoop lifted the curtain on the party's plan to tap voters' "fear" in the coming campaign season. The PR problem started when an absent-minded attendee at the Republican National Committee (RNC) confab on February 18 in Boca Grande, Florida, left a 72-page document from its 2010 strategizing session in a hotel room. Today, Politico reporter Ben Smith's expose is making headlines.

The memo tracks the fundraising presentation that RNC Finance Director Rob Bickhart delivered to the RNC's $2,500-a-head annual retreat. The best path to victory in 2010, the document advises, is for Republican candidates to depict themselves as the best hope for resisting the "trending toward socialism" taking shape in a Democrat-dominated Washington.

And the document doesn't shy from making its points graphically. MSNBC showed the images this morning on "Morning Joe":

The presentation portrays the Obama administration as "The Evil Empire," including the now-infamous image of President Obama made over in the makeup Heath Ledger used in his performance as the Joker in the 2008 Batman movie "The Dark Knight." House Speaker Nancy Pelosi appears as Cruella De Vil from "101 Dalmatians," and Senate Majority Leader Harry Reid is the witless cartoon dog Scooby-Doo. The memo candidly confirms that the aim of such caricature is to amp up "fear" among the GOP's conservative base. The memo also makes fun of major RNC donors, categorizing some as "ego-driven" and easily pacified with "tchochkes" (a Slavic word for toys).

The embrace of harsh rhetoric and the swipes at the large donor set seem to signal the GOP establishment's growing comfort with employing tactics associated with the activist Tea Party movement—and with plying Tea Party sympathizers for cash. Of course, it isn't unusual for parties out of power to court controversy and play with fire to rile up donors and grass-roots activists. The RNC has caught heat for

fundraising tactics in the past, most recently when it was

caught sending out fake census forms to raise money.

More...

3. From the ethereal, spiritual world of

EVOLUTION EZINE:

Cultures the world over use sound to attune to, invoke, and transform consciousness. Sound is a powerful tool, because it is vibrational in nature, and we are vibrational beings. Indeed the most modern science shows us that all life is vibrational in nature. This is in line with age old mystical thought of most cultures, which often alludes to the vibrational nature of Creation.

The Hindus have a saying, “Nada Brahma”, which means, all is sound, or all of creation is sound. They suggest that the primordial sound of manifest creation is the sound of “Aum”, or Om, and that if we were to attune to the creative spirit, we would hear this sound.

The Judeo-Christian culture might say, “In the beginning was the Word, and the Word was with God, and the Word was God (John 1:1),” thus also tieing together the nature and power of sound with Creation. Other cultures have stories stating that the Creator had a thought, spoke the word of that thought, and Creation of that thought sprang forth from that word into manifestation.

There are numerous theorems stipulating the melodic structures of the universe, from the spin of the planets around the sun, to the sun around the galaxy, to the spin of electrons in our body, and the structure of our DNA. Our modern music is based upon these principals derived from Pythagoras and others. (from What is Sound Healing which can be read in its entirety by visiting http://www.worldsoundhealing.org/SoundHealing.html )

When sounds are strung together they produce words. These words help us describe our experiences with the world around us. We use them to interact with others- to put form to – what is essentially formless. Just ask any quantum physicist and she will tell you – we are all energy.

Since man began combining sounds to communicate he has been been changing their initial meaning, coloring the sounds with experiences, with personal stories. Words became more and more personal, less and less Global.

Same word – different people – vastly different responses

We all know that to be true – just watch people’s reaction to the word God – super charged….

But underneath all the meanings and stories we have attached to individual words – the vibrations of the sounds that make up the words remain – and each has their own meaning – and their ability to align and empower us.

This audio has been designed to get underneath the stories we have placed on words and to realign ourselves with the power a pure vibrational match provides. It is very much a “Grand Experiment” that we Invite you to Participate In. Initial Results are exciting (see below) and not always what we expected.

More:

4. Here's an interesting piece about OIL PRICES, THE FACTIONING OF ISLAM, and other fascinating geo-political prognostication from

Agora Financial, an investment publication which urges its readers to pick stocks and other investments based upon anticipated political shifts throughout the world. While their timing might be a bit off, and while I don't promote their investment advice, they might be on to seing a serious internal jihad amongst warring factions of Islam...

1,354 Years in the Making:

The "NEW" War

That Could Rocket Oil

Past $220 Before 2011

by Byron King, Editor

What could be eight times bigger than the wars in Iraq or Afghanistan — and lethal enough to at least DOUBLE the price of gas and oil next year?

Brace yourself for the "new" and bloody war nobody saw coming... by bunkering down against soaring energy costs, thanks to a "safe haven" financial plan that could pay you gains up to 668%... |

|

|

Nobody in the Pentagon will talk openly about it. Nobody in the White House knows what to do.

But make no mistake...

What I'm about to show you could be the deadliest surprise threat to your money and livelihood of the coming year.

I say "new" because as you'll see there's not much

new about it at all — the pressure's been building behind this for the last

1,354 years!

Yet for the first time in history,

that pressure has found its release. I’m imagining a volcano of blood.

When it blows, you could see your savings get SLAMMED... the dollar thrown into a TAILSPIN... and, here's what will stun the still-recovering world economy,

gas and oil prices doubling or even tripling by sometime early in the coming year.

How on earth is that possible?

It's the last thing most people expect, from market pros to bumbling D.C. bureaucrats...

but if nothing changes in what I'm about to show you... this is a page in future history books that's already writing itself.

I'll show you the evidence myself.

If I'm right, as many as

eight key Islamic countries are hurtling headlong toward a bloody "new" war —

with each other — that's been FOURTEEN CENTURIES in the making.

This could begin as early as the next 12 to 18 months. And with no less than

66% of the world's key energy reserves smack dab in the crosshairs.

Sound impossible?

Even if I'm only half right, and we get an oil-state stalemate unlike anything the world has ever seen — you could see oil soar past the old high of $147.30 per barrel, well on its way to as much as $220... with gasoline bucking against a ceiling of $8 per gallon. More...

5. The highly conservative

CHRISTIAN SCIENCE MONITOR is expressing a growing concern about the increase in militias and militia movements in the United States:

Who is David Brian Stone, leader of the Hutaree Militia?

AP – This photo provided by the U.S. Marshals Service shows David Brian Stone Sr., 44, of Clayton, Mich. The …

AP – This photo provided by the U.S. Marshals Service shows David Brian Stone Sr., 44, of Clayton, Mich. The … By Will Buchanan Will Buchanan –

Mon Mar 29, 5:55 pm ET Members called him "Captain Hutaree" or, somewhat cryptically, "RD." A

federal indictment calls him the “principal leader” of the Hutaree militia – an extremist group federal authorities say was preparing to "levy war" against the US government by killing police officers.

He is David Brian Stone, and early media accounts sketch a portrait of a man pulled increasingly toward the

militia movement and its radical fringe. His ex-wife said she left him because he "got carried away." Federal authorities allege that he researched how to build roadside bombs on the Internet. And at least one neighbor said the group that Mr. Stone leads had acquired a certain notoriety around town.

"You don't mess with them," she told the Detroit News.

Monday morning, federal authorities released an indictment against Stone and eight other members of the Hutaree militia. They allege that Stone and his followers were planning an attack sometime in April, perhaps killing an police officer then targeting the funeral with improvised explosive devices (IEDs) to raise the death toll. The group saw the police as an arm of the US government, which they felt was the enemy.

It had not started out like this, said Donna Stone, David's ex-wife.

“It started out as a Christian thing," Donna Stone told reporters at the preliminary court hearing Monday morning. "You go to church. You pray. You take care of your family. I think David started to take it a little too far. He dragged a lot of people with him. When he got carried away, when he went from handguns to big guns, I was done."

“He dragged a lot of innocent people down with him," said Donna Stone, whose son was legally adopted by

David Stone and was among those indicted. “It started to get worse when they were talking about the world's gonna end in the Bible.”

According to the indictment, David Stone researched IEDs on the Internet and e-mailed diagrams of the devices to someone he believed capable of manufacturing the devices. He then directed his son, Joshua, and others to gather materials necessary for the manufacturing of the bombs.

The indictment further concludes that in June 2009, "Stone taught other Hutaree members how to make and use explosive devices intending or knowing that the information would be used to further a crime of violence."

Other militia groups in Michigan distanced themselves from David Stone and the Hutaree.

"I've met him. He's an opinionated man who likes to share those opinions," Jim Gulliksen of the

Lenaway Volunteer Michigan Militia told the Detroit News. "The Hutaree is a nationwide group, but I have met a couple of the members here, and I can say they all belong to one specific church. Our concern is the protection of our nation. Religion appears to be a big part of what they are doing."

According to the group’s website

Hutaree.com, Hutaree means “Christian Warrior.” The website announces: “The Hutaree will one day see its enemy and meet him on the battlefield if so God wills it.”

More...

6. And, of course,

The Davinci Institute offers some wonderful visionary thinking about the future and trends without any particular political slant except for an appreciation of science and the excitement of trying to predict the future in its

Future Trend Report:

More Doctor's Moving Away From Private Practice and Going Into Big Health Care Organizations

A quiet revolution is transforming how medical care is delivered in this country, and it has very little to do with the sweeping health care legislation that President Obama just signed into law. But it could have a big impact on that law's chances for success. Traditionally, American medicine has been largely a cottage industry. Most doctors cared for patients in small, privately owned clinics - sometimes in rooms adjoining their homes. Continue reading

In the App World, Smartphones Are Taking Over Computers

Meet Barbara Place. She's an app-aholic. One look at her smartphone explains her condition.She has an app to wake her, a few to provide the day's news, one to check her bank account, another to make a grocery list, two to track her diet and one to get the weather. She has an app for baseball scores and an app for movie data. One app lets her program her DVR from afar. Another helps her unwind with quizzes about famous artworks. And that's just a portion of her daily intake. Continue reading

Chinese City is World Capital of Cyber- Espionage

A city in eastern China has been identified as the world capital of cyber-espionage by an American internet security company. The firm traced 12 billion emails in a study which showed that a higher number of "targeted attacks" on computers come from China than previously thought. Continue reading

FDA Pressured to Take On Food Fraud

The expensive "sheep's milk" cheese in a Manhattan market was really made from cow's milk. And a jar of "Sturgeon caviar" was, in fact, Mississippi paddlefish. Some honey makers dilute their honey with sugar beets or corn syrup, their competitors say, but still market it as 100 percent pure at a premium price. Continue reading

American Companies Could Control 40% of Lithium-Ion Battery Market by 2015

In February, President Barack Obama told the crowd at a Henderson, Nev., high school that not so long ago, the U.S. made barely 2% of the advanced batteries used in the world's electric vehicles. Now, thanks to a multibillion-dollar federal investment, American companies are positioned to increase production tenfold - and potentially control 40% of the global lithium-ion-battery market by 2015. "We've created an entire new industry," Obama said. Continue reading

Airlines Saw a Significant Drop in Passengers and Revenue in 2009

The global economic downturn took 68.6 million scheduled airline passengers out of the USA's skies over the last two years. Last year, 769.6 million travelers boarded planes in the U.S. or planes bound for the U.S., according to new data from the Bureau of Transportation Statistics. That's down 5.3% from 812.3 million passengers in 2008 and down 8.2% from the record 838.2 million air travelers in the U.S. market in 2007. Continue reading

Debt-Settlement Fraud on the Rise

Baltimore resident Gloria Snowden thought she had found a way out from under her $10,000 credit card bill when she signed up with a company that promised to negotiate with creditors to settle the debt for less than she owed. Continue reading

Many Baby Boomers will be Forced to Work Long Into Their Retirement

The recession is reshuffling retirement plans for baby boomers - a demographic tsunami, accustomed to setting the agenda, that finds itself scrambling as the oldest boomers turn 64. Only 53 percent of workers 55 and older have even tried to calculate how much they need for retirement, according to a 2010 survey by the Employee Benefit Research Institute, and 29 percent report less than $10,000 in savings and investments. It's little wonder that just 13 percent said they were confident they had enough to live comfortably in retirement. Continue reading

1.3 Billion People But China Still Faces a Labor Shortage

In the labor market's pecking order, Chen Xiulan is at the very bottom. She is female, middle-aged and from the countryside and stands barely 5 feet tall. (Height requirements are common with Chinese employers.) Yet when the nearly 60-year-old grandmother from Sichuan province showed up in Shanghai last fall looking for work on the construction site of the sprawling World Expo, nobody laughed. Chen was handed a hard hat and a broom and put to work with the crew that sweeps up debris. Continue reading

Extreme Dieting in Asia on the Rise

This glamorous Asian city is known for its mouth- watering dim sum. Its high fashion. And its 100-pound- and-under women. Agatha Yau, a marketing executive, is one of these women. She has done many things over the years to stay trim: taken diet pills, eaten meals of boiled vegetables and practiced delaying gratification. Continue reading

As for myself, I am in the process of preparing two or three articles about shocking socio-economic changes which will impact every aspect of our lives -- and not in a good way. On the constructive side, I will try to provide you with various means of avoiding or mitigating the effects of these revolutionary, earth-shattering changes.

Faithfully,

Douglas Castle

About Douglas Castle

Douglas Castle - LinkedIn Profile

The National Networker Companies

Braintenance - Stay razor sharp.

The Internationalist Page - A world without barriers.

The Global Futurist - Revealing trends.

Taking Command! - Mastering your fate.

Follow Castle on Twitter

Follow TNNW on Twitter

Follow Braintenance on Twitter

*Subscribe (free!) for The National Networker Newsletter and the BLUE TUESDAY REPORT, and join The TNNWC GICBC at Join Us!

About Douglas Castle

Douglas Castle - LinkedIn Profile

The National Networker Companies

Braintenance - Stay razor sharp.

The Internationalist Page - A world without barriers.

The Global Futurist - Revealing trends.

Taking Command! - Mastering your fate.

Follow Castle on Twitter

Follow TNNW on Twitter

Follow Braintenance on Twitter

*Subscribe (free!) for The National Networker Newsletter and the BLUE TUESDAY REPORT, and join The TNNWC GICBC at Join Us!